Oil Prices Drop 2% Despite Wave of Bullish News

December 11, 2025

Oil prices slid nearly 2% on Thursday in a move that ran against a rare alignment of bullish signals—from OPEC’s upbeat December MOMR to a softer glut forecast from the IEA and fresh U.S. inventory draws.

Brent fell toward $61…

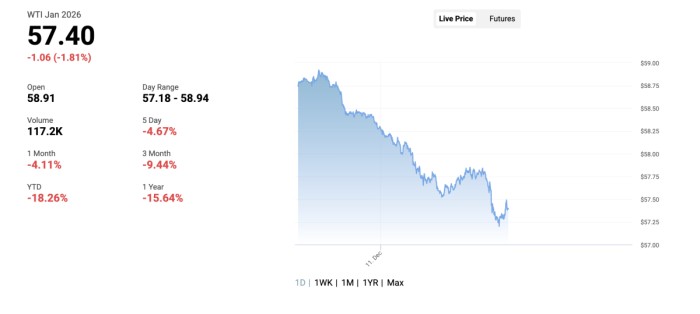

And WTI toward $57…

Extending a losing streak that now spans most of December.

OPEC’s latest monthly report maintained a firm demand outlook for 2025–26, pointing to resilient consumption in China, India, and the Middle East while reiterating that non-OPEC supply growth is set to moderate after 2025. The group also noted that OPEC+ supply management continues to anchor market stability—a markedly more optimistic stance than the IEA’s earlier glut-heavy narrative.

Even the IEA shifted tone. In its latest update, the agency trimmed the projected 2026 surplus for the first time since May, cutting its glut forecast from 4.09 million bpd to 3.84 million bpd as sanctions on Russia and Venezuela curb supply and as global demand proves stronger than previously assumed. Improved macro conditions and easing tariff concerns also prompted the IEA to revise 2026 demand growth upward by 90,000 bpd.

U.S. fundamentals leaned supportive as well. API reported a 4.8-million-barrel crude draw, and the EIA on Wednesday confirmed a 1.8-million-barrel draw, reinforcing signs of firm winter demand.

Geopolitics added another layer of upside risk: Ukraine said its SBU drones struck Russian oil infrastructure in the Caspian Sea for the first time, targeting Lukoil-linked assets—a new geographic expansion of the conflict’s energy front.

Yet futures still fell. Traders pointed to thin liquidity, algorithmic selling, and fund de-risking as the curve remains stubbornly flat.

So while the fundamentals tilted bullish, the tape didn’t follow—a reminder that sentiment, not balance sheets, is still driving December crude.

=Oilprice.com=