Why U.S. Electricity Prices Are Surging Despite Promises of Relief -EIA

Jul 03, 2025

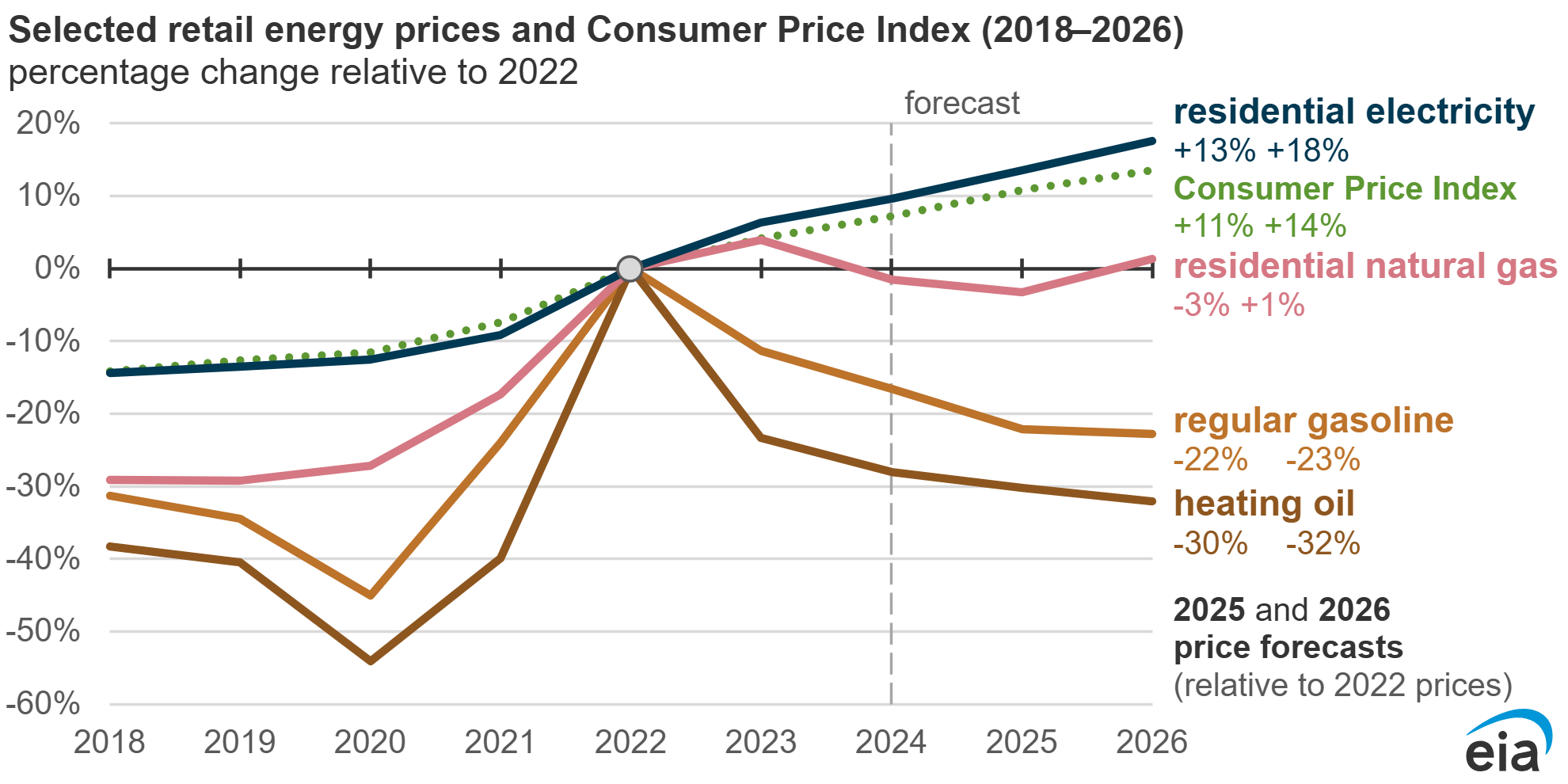

U.S. electricity prices have risen faster than inflation since 2022 and are projected to increase by 13% from 2022 to 2025, driven by infrastructure costs and soaring demand.

Rapid growth in energy consumption by data centers and electric vehicles is straining the grid and could soon surpass supply, exacerbating future price hikes.

Policy changes, including the potential rollback of renewable energy tax credits, may further disrupt the energy transition and contribute to higher consumer costs.

Despite promises to bring consumer bills down, electricity prices in the United States have surged in recent years. According to the U.S. Energy Information Administration (EIA), retail electricity prices have risen more rapidly than the rate of inflation since 2022, a trend that is expected to continue through 2026. Prices have increased by 4.5 percent over the past year, at almost double the rate of inflation for all goods and services.

The price increases since 2020 can be blamed largely on the disruption of supply chains during the COVID-19 pandemic and the 2022 Russian invasion of Ukraine, which spurred the introduction of sanctions on Russian energy products. Prices have also risen due to several U.S. utilities increasing capital investment for the replacement or upgrade of ageing generation and delivery infrastructure.

The nominal price of several fuels has declined since 2022, as crude oil prices have declined, particularly gasoline and heating oil, while electricity prices have continued to steadily increase. U.S. consumers spent an average of $1,760 on electricity expenditures in 2023.

The EIA expects the nominal U.S. average electricity price to increase by 13 percent from 2022 to 2025, although this will vary significantly from region to region. This means that consumers may spend an additional $219 on their household electricity bills in 2025 compared to 2022. Regions such as the Pacific, Middle Atlantic, and New England, which already pay higher electricity prices, could face greater increases.

The average U.S. household paid around 17 cents per kilowatt-hour of electricity in March 2025. However, this varied from a low of around 11 cents per kWh in North Dakota to around 41 cents per kWh in Hawaii. Looking forward, prices for households in the Pacific region are expected to rise by as much as 26 percent from 2022 to 2025. By contrast, households in the West North Central region could see a price increase of 8 percent.

The forecast price increases will depend heavily on supply and demand. The U.S. demand for electricity is expected to grow significantly over the coming years, as several new energy-guzzling projects suck electricity from the grid.

The boom in data centres across the U.S. – giant warehouses of computer servers and other IT equipment that are used to power advanced technologies, such as artificial intelligence (AI), are expected to drive up demand significantly over the coming decades. Some fear that the demand for electricity in the U.S. could soon outstrip supply, as utilities nationwide race to connect new clean energy projects to the grid. This is likely to lead to higher electricity prices over the coming years.

The growth in U.S. electricity demand was minimal in previous decades, thanks to improvements in energy efficiency. However, the demand for electricity to power data centres tripled between 2013 and 2023, driving the overall demand up at a fast rate, according to the U.S. Department of Energy.

Electricity use by data centres is expected to double or triple again by 2028 and then continue growing. Data centres are therefore set to consume as much as 12 percent of the total U.S. electricity demand, a significant increase from 4.4. percent in 2023. By the end of the decade, data centres will likely be consuming greater quantities of electricity than the manufacture of all energy-intensive goods combined, including aluminium, steel, cement, and chemicals.

In addition, the shift away from fossil fuels to cleaner alternatives, such as renewable energy sources and nuclear power, will lead to the greater electrification of households. Similarly, the anticipated increase in the uptake of electric vehicles will drive up the demand for electricity countrywide.

One move that could help alleviate the price pressure is the modernisation of the U.S. grid. Most U.S. electricity transmission infrastructure is outdated and not prepared for the influx of renewable energy waiting to be connected. Making the grid system more efficient in delivering power, as well as investing in utility-scale battery storage, could help drive down prices. However, to achieve this, utilities across the country must invest heavily in infrastructure, which will likely lead to a mid-term price hike.

In June, several media sources reported that, if passed, a Domestic Policy Bill sponsored by Trump may derail several renewable energy sectors and drive up consumer prices. The bill was expected to abruptly end many of the Biden-era federal tax credits for low-carbon sources of electricity such as wind, solar, batteries, and geothermal power. After some amendments, the bill just passed the Senate.

It will now be sent back to the House for approval in its updated version, but it could mean a halt in progress for U.S. green energy and may result in higher energy prices for consumers in the coming years, spelling greater uncertainty for the future of the U.S. energy supply.

Oilprice.com