NUPRC Secures Over $400m In Pre-Sale Decommissioning/Abandonment Liabilities

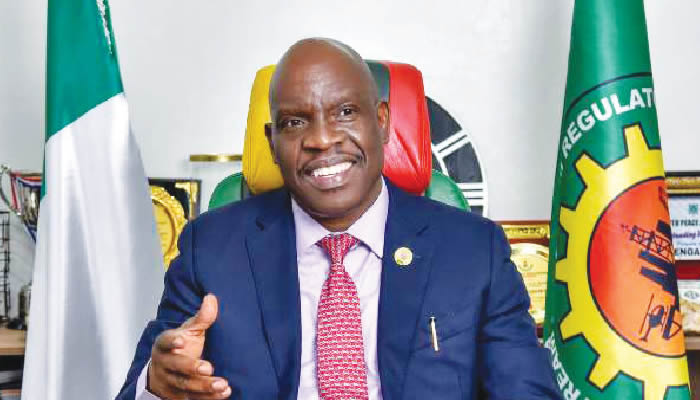

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Chief Executive, Gbenga Komolafe, revealed on Wednesday that it has secured over $400 million in pre-sale decommissioning and abandonment liabilities from recent oil asset, in a bold move to prevent Nigeria from costly environmental and financial burdens.

He disclosed this while speaking at the Nigerian Extractive Industries Transparency Initiative (NEITI) Companies Forum held in Lagos.

Represented by the commission’s Deputy Director, Human Resources, Corporate Services & Administration, Efemona Bassey, spoke on the theme, “Divestments, Liabilities, and the Impact of Ongoing Reforms on Extractive Companies in Nigeria.”

The NUPRC boss said the Commission drew lessons from international divestment cases, including the North Sea, where decommissioning is projected at £27bn by 2032; the Gulf of Mexico, which has cost over $9bn; and Canada’s Alberta, where more than 97,000 inactive wells carry estimated decommissioning costs of between C$30bn and C$70bn.

In Australia, Northern Oil & Gas Australia in 2019 left behind liabilities of more than AU$200m.

He explained that the experiences guided the recent divestment approvals from NAOC to Oando Energy Resources; Equinor to Chappal Energies; Mobil Producing Nigeria Unlimited to Seplat Energies; SPDC to Renaissance Africa Energy; and TotalEnergies to Telema Energies.

Stating that “Without a robust and enforceable framework for abandonment and decommissioning, divestment transitions can create lasting financial and environmental burdens.

“Nigeria is not immune to this challenge, and if we are to avert costly mistakes. It is precisely to avoid this outcome that Nigeria, through the Petroleum Industry Act and subsequent regulatory actions, has taken bold and decisive steps.”

He highlighted Nigeria’s response to the recent divestments in line with Sections 232 and 233 of the PIA which place full responsibility for the decommissioning and abandonment of petroleum wells, installations, structures, utilities, plants, and pipelines on licensees and lessees.

He said each of the 2024 divestments provided a critical opportunity to put the Commission’s Divestment Framework to test and action: rigorously assessing the technical capacity of acquiring entities, verifying their financial strength, and securing decommissioning and abandonment obligations through upfront escrow arrangements.

Komolafe said, “The results from 2024 speak for themselves. Over US$400 million in pre-sale decommissioning and abandonment liabilities have been secured through Letters of Credit and escrow accounts.

“Host Community Development Trust obligations are fully honoured. Environmental remediation commitments worth over $9.2m have been pledged while awaiting the formal gazetting of the ERF Regulations.”

The CE stated that “Since April 2023, we have approved 94 Decommissioning and Abandonment (D&A) plans, in strict alignment with the PIA. These approvals represent total liabilities of $4.424 billion, arising from all Field Development Plans submitted within this period, and will be remitted progressively over the production life of the respective fields into designated escrow accounts,” he added.

He further disclosed that the Commission has addressed a long-standing concern with the IOCs regarding the domiciliation of the escrow accounts; and the regulatory framework, developed after extensive consultations with industry stakeholders, is now awaiting gazetting by the Ministry of Justice.

He acknowledged the invaluable role of NUPRC partners, NEITI and Oil Producers Trade Section (OPTS).

He reaffirmed that the ethics of the extractive industry, NEITI has consistently ensured that NUPRC embedded transparency and disclosure in all its regulatory processes while OPTS, the united voice of producers, has supported us in shaping regulations that balance industry realities with national priorities.