Breaking: EFCC, Immigration Repatriate Foreign Cybercriminals: 42 Deported, 150 More to Follow

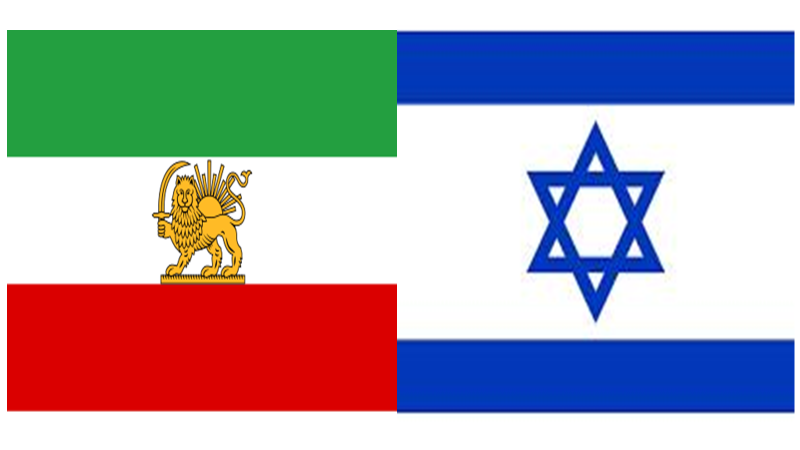

Iran-Israel Ceasefire: Rising Global Supply Of Oil Outweigh U.S. Demand Strength

Jun 27, 2025

Iran-Israel Ceasefire, Crude oil markets endured a sharp four-day selloff from June 22-26, driven by collapsing geopolitical risk premiums and mounting global supply. The steep decline wiped out nearly all the gains from mid-June’s heightened Middle East tensions, as traders recalibrated around fresh supply-side realities and emerging demand concerns.

Iran-Israel Ceasefire Removes Key Supply Risk

Oil’s abrupt decline was catalyzed by a ceasefire agreement between Israel and Iran, announced late Monday by U.S. President Donald Trump. Though Israel accused Iran of violating terms shortly after, the truce held. For traders, this effectively neutralized the immediate threat of disruption to Persian Gulf flows, particularly through the Strait of Hormuz, which handles around 20% of global oil traffic.

Iran’s oil exports—over 2 million barrels per day (bpd) from a 3.3 million bpd output base—were no longer seen at risk. The geopolitical premium that had built since Israel’s initial strike evaporated almost instantly. “The risk premium built up since the first Israeli strike… has entirely vanished,” noted Tamas Varga of PVM Oil Associates. Positioning shifted rapidly out of Middle East exposure, slamming crude prices.

Oilprice.com