REA Reconfirms Commitment to Energize Underserved Communities Across Nigeria

Natural gas looks so appealing to investors this Summer & Beyond Due To High demand For Electricity

June 5, 2025

The gas market was highly seasonal and regional, but now it’s ‘globally integrated,’ says portfolio manager. Natural gas is expected to provide the largest share of net U.S. summer generation capacity, according to the Federal Energy Regulatory Commission.

It’s that time of year again, when the need for cooling in the summer heat lifts demand for natural gas — but that’s not the only factor raising the risk for tighter supplies of the fuel, making natural gas that much more appealing for investors after a nearly 10% drop in prices so far in the second quarter.

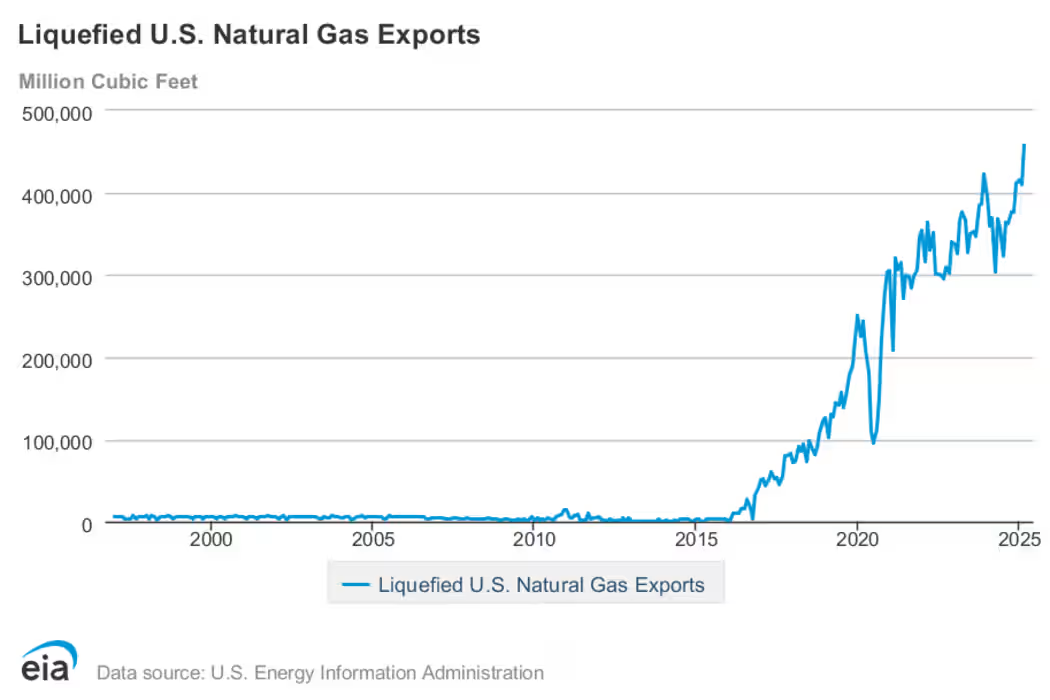

Summer cooling demand, along with low U.S. storage levels, risks tied to the Atlantic hurricane season and growth in liquified-natural-gas (LNG) exports will all play a role this summer, but “not equally,” said Henry Hoffman, co-portfolio manager of the Catalyst Energy Infrastructure Fund.

“The gas market used to be highly seasonal and regional. Now, it’s globally integrated“— Henry Hoffman, Catalyst Energy Infrastructure Fund

“The gas market used to be highly seasonal and regional. Now, it’s globally integrated,” he said.

The most significant driver for natural gas will likely be power demand, said Hoffman. Summer electricity demand is expected to be above the five-year average, and “across all regions, natural gas is expected to provide the largest share of net summer generation capacity,” according to the Federal Energy Regulatory Commission’s annual Summer Energy Market and Electric Reliability Assessment released on May 15.

“Natural gas remains the dominant fuel source for dispatchable generation, especially as renewables can be intermittent,” said Hoffman. Renewable energy sources such as solar and wind, for example, aren’t reliable because they are dependent on natural sources that cannot be controlled.

Power demand

Given the importance of natural gas as a key source for power demand this summer, it can potentially see a sustained drawdown from inventories and a rise in prices, particularly during heatwaves, said Hoffman.

A hotter-than-normal summer would lead to higher demand for natural gas, and that higher demand will “compete with the replenishing” of natural gas in storage for the winter heating season, driving prices higher, said Simon Wong, portfolio manager at investment firm Gabelli Funds.Most-active natural gas futuresSource: FactSetJuly 2024’251.52.02.53.03.54.04.5$5.0

On Wednesday, natural gas for July delivery

NGN25+2.94% settled at $3.72 per million British thermal units, after settling Tuesday at the highest finish for a front-month contract in more than three weeks, according to Dow Jones Market Data. Prices have gained about 2.3% year to date, but have lost 9.8% in the second quarter.

U.S. supplies of natural gas in storage, meanwhile, have started the summer season lower than last year, with inventories at 2.476 trillion cubic feet for the week ended May 23, according to the Energy Information Administration. That’s 316 billion cubic feet (bcf) below the same time a year ago.

Hoffman cited a colder winter and “ongoing production discipline” for the lower supply, adding that there’s “less buffer if demand spikes or supply is disrupted.”

Storm-related risks

Supply, meanwhile, has the potential to see disruptions tied to the Atlantic hurricane season — not just in terms of production, but also in infrastructure and consumption, said Hoffman. The hurrican season runs from June 1 to Nov. 30.

Production in the Gulf of Mexico currently is “small” — down from its 2009 peak of over 7 bcf per day to roughly 1.7 bcf per day — but “infrastructure vulnerability is still real,” said Hoffman. In September of last year, the EIA expected natural-gas production in the Gulf to average 1.8 bcf in 2025, which it said would represent 2% of U.S. marketed natural-gas production.

LNG terminals like Sabine Pass, Cameron and Freeport are all Gulf Coast-based and hurricanes can delay cargoes, creating force majeure (a circumstance preventing the fulfillment of a contract) or reducing export capacity temporarily, Hoffman noted. “That affects both domestic prices and global supply,” he said.

Gulf Coast LNG production is now around 15 bcf per day and rising, so storms may more likely have a downward effect on natural-gas prices, Hoffman added.

LNG exports

Overall, however, the U.S. is in a “structural ramp-up” in terms of LNG capacity, with facilities like Golden Pass and Plaquemines LNG expected to come online, Hoffman said. The next wave of projects — such as Corpus Christi Stage 3, which aims to expand LNG production capacity and is developed by Cheniere Energy Inc.

LNG-0.33%, and export facility Rio Grande LNG, which is under construction by NextDecade Corp.

NEXT+2.21% — will help grow exports, further tightening the domestic market into 2026 to 2028, he noted.

MarketWatch.com (By Myra P. Saefong)